There are only 8 new retail projects that will open in 2023.

Please click on the links below to see the details for each new project.

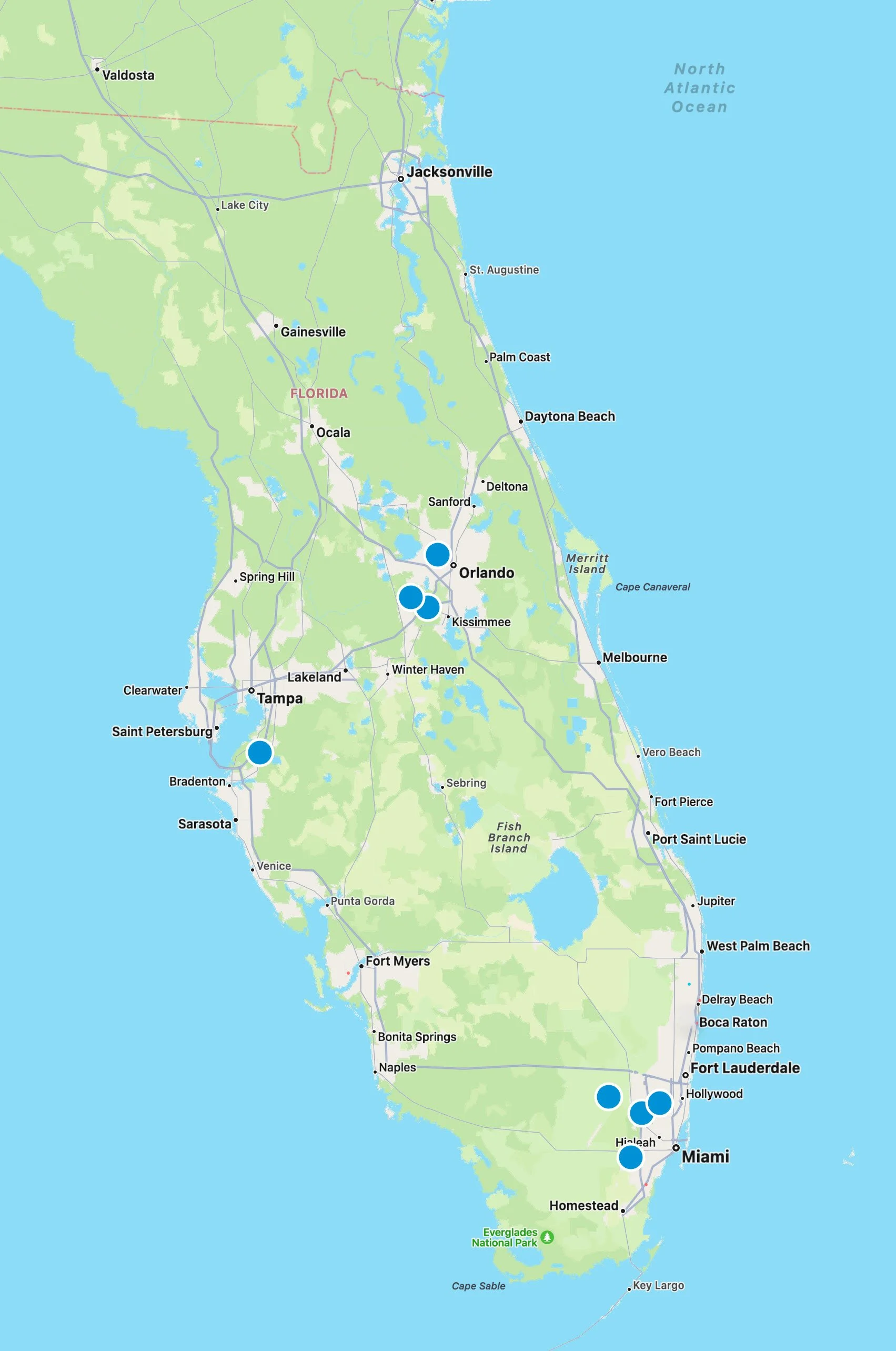

2023 Annual Openings: Florida Major Markets

growth

Please click on the links below to see the details for each new project.

2023 Annual Openings: Florida Major Markets

However, in those years when a large volume of projects trade, they do so at significantly lower cap rates. In 2005, the average large transaction traded for a 7% cap; today, those projects are trading for a 5% cap. We project cap rates will continue this downward trajectory and dip below 5% in 2022, possibly signaling a period of an irrational exuberance.

This might seem alarming, but it isn’t an apocalyptic indicator that retail is dying; rather, the data indicates that the nature of retail itself is changing. With the rise of curbside pickup, delivery services, and front-door stores seeing increased back-door sales, the average square footage of retail space per person in the state will contract over the next decade and retail development will nearly stop. In the 1980’s, Florida had approximately 17 sf retail space per person. By 2030, we will return to that level. This is just another system that is going through self-optimization.

How do we know if we are recovering from Covid? My number one metric is Consumer Confidence. If we can bring back confidence we will arrive safely at the otherside of this crisis. We all have to do are part and then it will truly be the roaring 20s. Onward!

The United States is projected to grow by nearly 79 million people in the next 4 decades, from about 330 million to 404 million between 2020 and 2060. The population is expected to grow by an average of 1.8 million people per year between 2020 and 2060. The US needs population growth and productivity growth to fuel economic growth. Over 60% of the population gains will result from immigration and the balance will be from new births. Imagine 400M in the US - what an opportunity. Onward!

“Imagine 400M in the US - what an opportunity.”

History is on our side - they may well be the "roaring 2020's". The average time between recessions has grown from about two years in the late 1800s to five years in the early 20th century to eight years over the last half-century.

It’s been 13 years since the last recession began in Dec. 2007. That’s the longest we’ve gone without starting a new recession ever, going back to before the Civil War. Hopefully, the roaring 2020's will be a decade without any downturns.

Onward!

When I was born there were only 3.0B people. Today there are nearly 8.0B and somehow, in the last 60 years, we managed to thrive. The world population is projected to reach 9.9 billion by 2050, an increase of more than 25% from the current 2020 population of 7.8 billion. Total fertility rates are below the replacement level of 2.1 births per woman in 91 countries and territories, mostly in Asia and Europe, as well as in the United States. What a great time to be alive. Notice that the world's population growth rate is dropping like a rock. America is still the leader. Let's all help keep it that way.

“The world population is projected to reach 9.9 billion by 2050, an increase of more than 25% from the current 2020 population of 7.8 billion”

Every once and awhile you see something that leaves you speechless. This chart is from a report just issued by Eastdil Secured and it hit me like a gut punch. I couldn't believe that I had missed something that was so obvious. All of the major classes of commercial real estate over the last 15 years have grown their rental streams by 3-4% annually. But there is one glaring exception, and that is retail properties which did not have any rental growth over the last 15 years. Now, during that period, retail sales grew by 3.75% per year, and yet, retail is still at the levels of 2005. That is shocking. What do you think about this? Please post a comment.

My favorite players in the chess game of the retail marketplace is number 1 ranked Walmart, the grandmaster, vs up-and-comer "Beth Harmon", Amazon. Watching this game play out is better than watching the Queen's Gambit on Netflix. Notice how Walmart's growth has followed the classic "S-Curve" and Amazon is still in their hockey stick explosive growth phase.

Who knows how this one ends?